nh food tax calculator

This includes Social Security. Nh Food Tax Calculator.

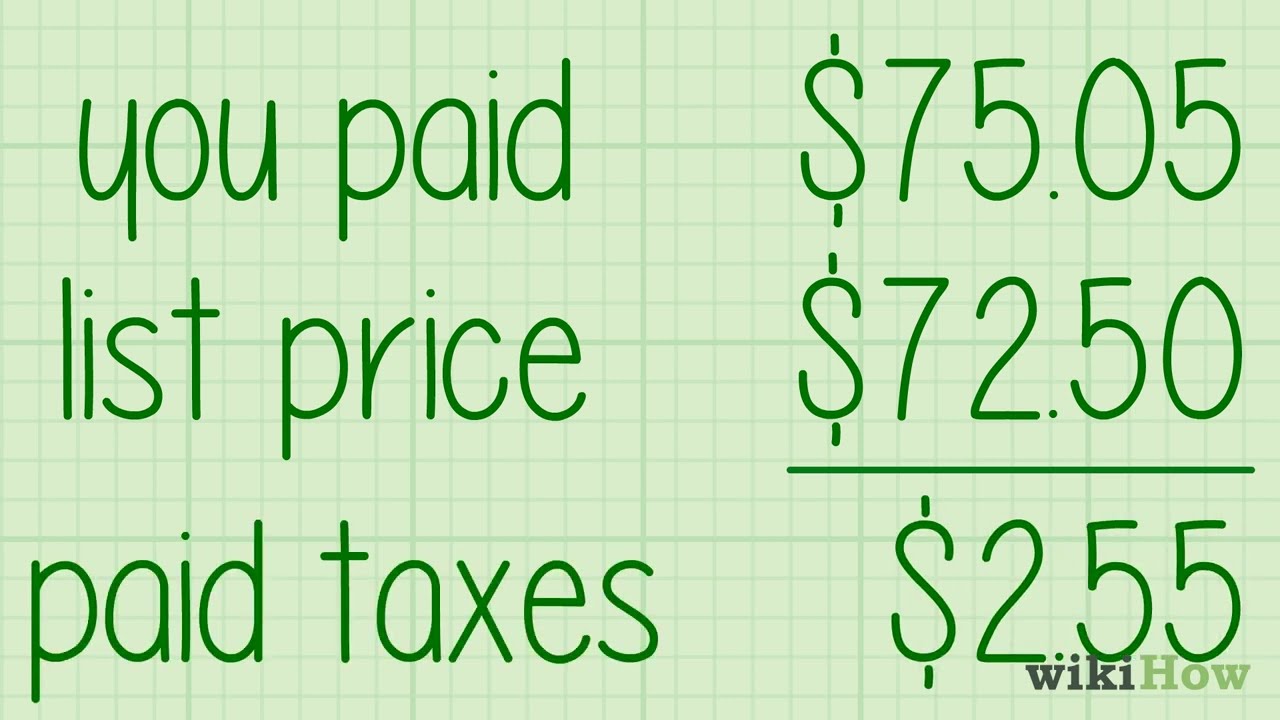

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Assessing department tax calculator.

. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes. No state-level payroll tax.

A 9 tax is also assessed on motor. The assessed value multiplied by the tax rate equals the annual. The median property tax on a 24970000 house is 464442 in New Hampshire.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. 54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. Can claim state exemptions.

The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value. Immigrants can be eligible for SNAP depending on their immigration status. New Hampshire Hourly Paycheck Calculator.

The New Hampshire bonus tax percent calculator will tell. New Hampshire Income Tax Calculator 2021. Advance Child Tax Credits ACTC payments are early IRS.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. New Hampshire Salary Tax Calculator for the Tax Year 202223 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202223.

Your average tax rate is 1198 and your. New Hampshire tax year. For transactions of 4000 or less the minimum tax of.

2022 New Hampshire state sales tax. Nh Food Tax Calculator. The state does tax income from interest and.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code. Start filing your tax return.

Include children 21 or younger parents and spouses if they live with you. 2013 City of Concord NH. The state does tax income from interest and.

There have been important changes to the Child Tax Credit that will help many families receive advance payments. Enter your info to see your take home pay. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

New hampshire salary tax calculator for the tax year 202122 you are able to use our new hampshire state tax calculator to calculate your total tax costs in the tax year 202122. For additional assistance please call the Department of Revenue Administration at 603. The median property tax on a 24970000 house is 464442 in New Hampshire.

If you earn normal wage there is no income tax. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0.

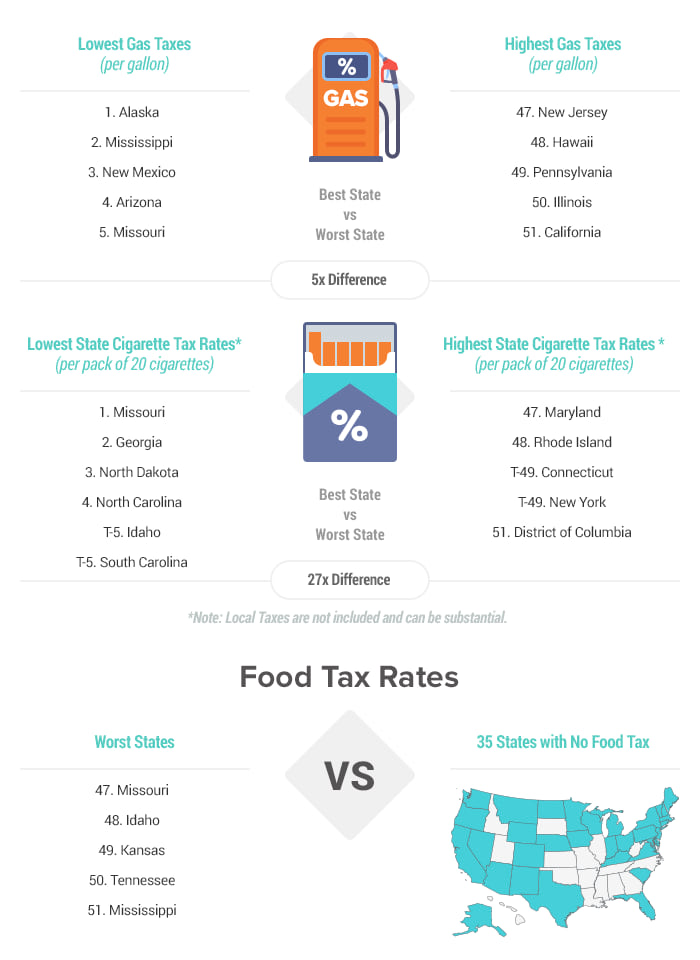

States With The Highest Lowest Tax Rates

How Is New Hampshire S Real Estate Tax Calculated

New Hampshire Income Tax Calculator Smartasset

Upper Valley Area Faq S Housing Solutions Real Estate

New Hampshire Could Become The Ninth Income Tax Free State Tax Foundation

New Hampshire Sales Tax Rate 2022

Timber Basis Decision Model A Calculator To Aid In Federal Timber Tax Related Decisions Extension

Sales Taxes In The United States Wikipedia

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

New Hampshire Income Tax Calculator Smartasset

New Hampshire Paycheck Calculator Smartasset

Sales Taxes In The United States Wikipedia

2021 Taxes And New Tax Laws H R Block

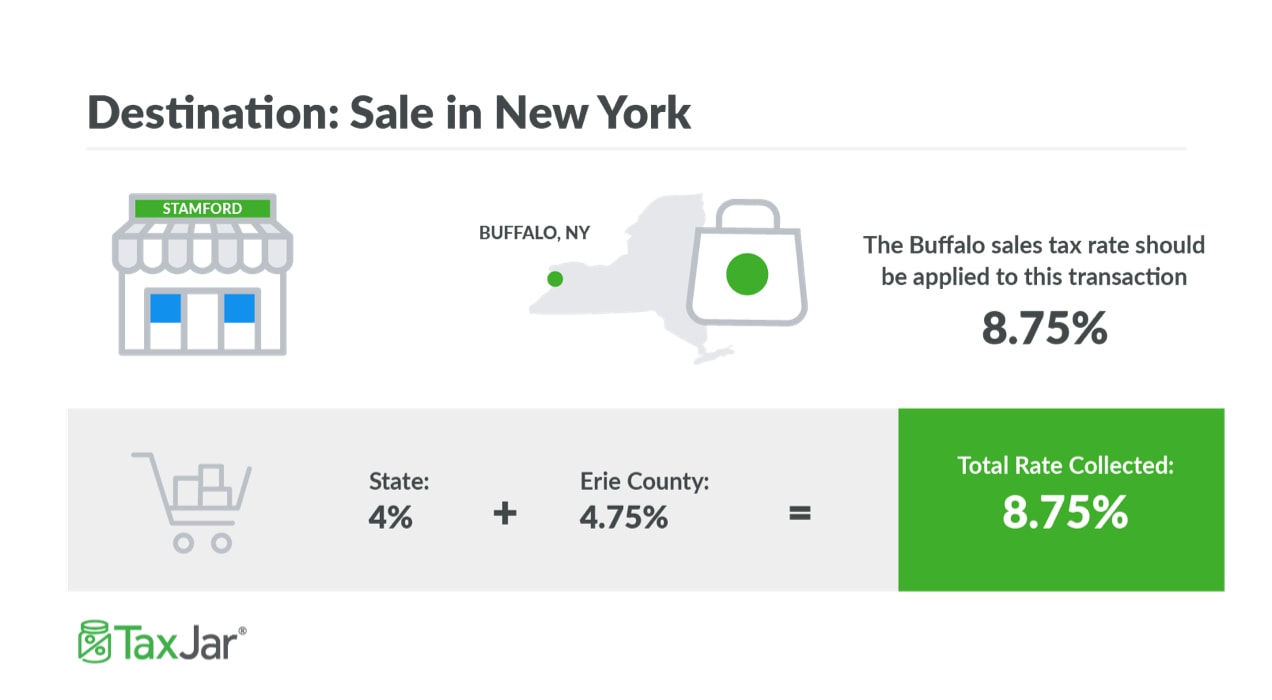

New York Sales Tax Everything You Need To Know Smartasset

How To Charge Your Customers The Correct Sales Tax Rates

Federal Deadline May Have Been Extended But Nh State Taxes Are Still Due April 15 Nh Business Review